Life Tenancy Investments

Purchase UK Property With Up To 60% Discount

3 Reasons you will love Life Tenancy Investments:

Purchase UK Property With Up To 60% Discount

3 Reasons you will love Life Tenancy Investments:

Unique Strategy of Property Investing

Life Tenancy Investing is an established but little known property investment strategy that comes with a Life Tenant who pays the remainder of the house price.

The Life Tenant secures a home to live in for their remaining years while you enjoy massive discount and capital appreciation.

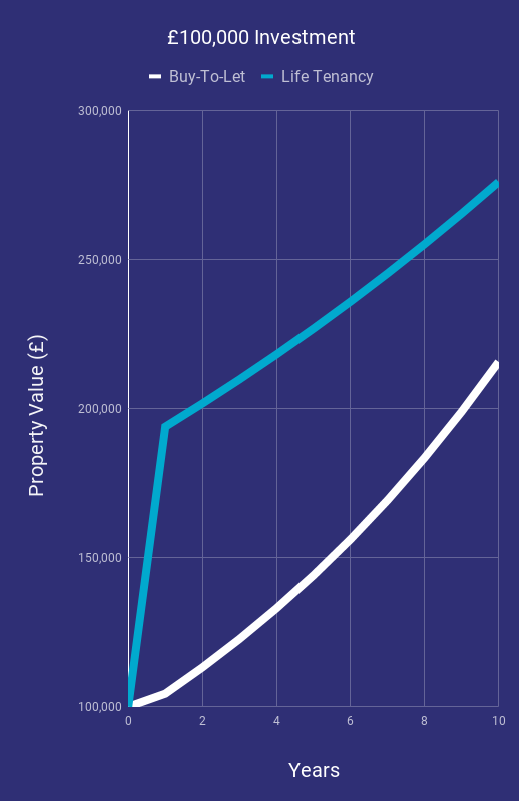

Accelerate Your Return on Investment

- Buy to Let figures based on average net rental yield of 4.4% after factoring in letting agency fees, service charges, insurance as well as average capital growth in the UK of 4%

- Life Tenancy Investment figures based on average discount of 47% and average capital growth in the UK of 4%

- As with all investments, the value can go down as well as up and you may not get back the original amount you invested.

Huge Discount

Average 47% below RICS valuationAverage 47% below RICS valuation

The Life Tenant essentially pays their rent upfront allowing you to purchase property with a huge discount.

No Extra Stamp Duty

Exempt from the 3% stamp duty surchargeExempt from the 3% stamp duty surcharge

Life Tenancy Investments are not subject to the additional surcharge of stamp duty (UK property purchase tax) that you would have to pay if purchasing a Buy-To-Let Property

Two Factors of Profit

Massive discount & house price inflationMassive discount & house price inflation

Not only do you earn a massive discount from day one but you also get exposure to years of house price inflation.

No Property Maintenance

The Life Tenant is responsible for all upkeep & maintenanceThe Life Tenant is responsible for all upkeep & maintenance

The upkeep and maintenance is the responsibility of the life tenant giving you a real hands-off investment.

Get The Full Picture

Download the ebook to learn everything you need to know about

Life Tenancy Investments