Concern has been expressed at changes announced by the UK government which will have an impact upon probate (the legal term for “proving” a will in court to be the true last testament of the deceased) fees paid on property in the UK. The current system where beneficiaries of a will pay a flat rate probate fee will be replaced by a tiered system of payment.

The new system which will be introduced in May 2017 will result in potentially large increases in fees paid on estates in excess of £50,000 ($62k, €59k). At the moment, a flat rate fee of £215 (or £155 if a solicitor or lawyer is used) is charged but the new probate system will mean fees of between £8,000 and £20,000 for estates in excess of £1m.

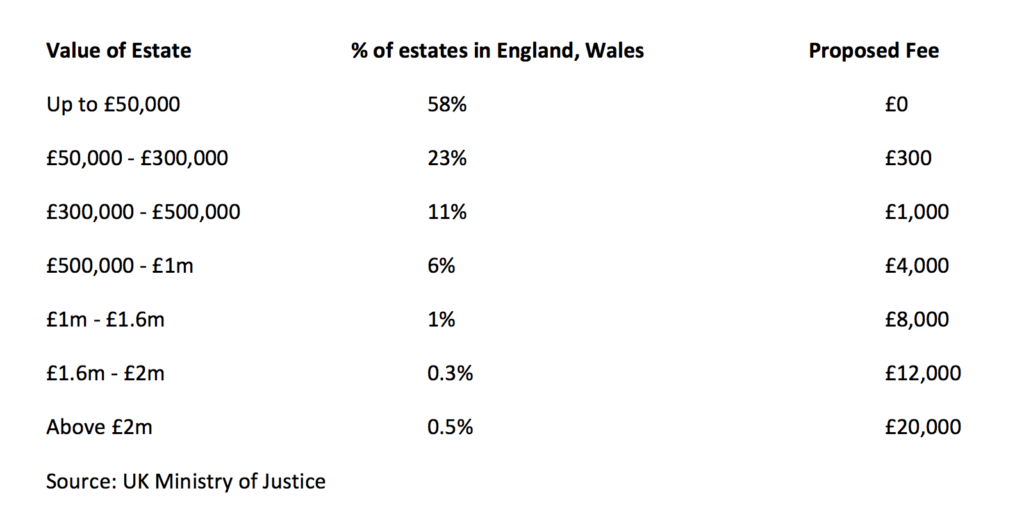

The impact will be widespread because of the steady increase in UK house prices and is summarised below:

The system to be implemented in May has been described as a “stealth tax” which will lead to a situation where higher value cases fund the probate service for low value cases. While many financiers agree that a tiered system is, in theory, equitable there is concern over the level of fees which will be imposed.

The UK property market remains uncertain due to the complexities which will arise through Brexit and it is feared that the proposed changes will add further complexity to estate planning. The potential increase in probate costs can be offset through the use of trusts to reduce the value of an estate thereby reducing probate charges.